最近经常有学生来问如何在A-level经济学论文中进行评估,虽然有多种可能的方法,但如果不确定,有一个好方法可以开始,那就是使用“depends on”方法。下面为大家详细介绍一下。

一、构建Evaluation段落

如果不确定如何开始,一个可靠的方法是“depends on”。考虑以下评估阶段:

•说明“depends on”某些因素。

•解释为什么你的分析依赖于这个因素。

•或者

a)选择一方——提到的因素是高还是低,弹性还是非弹性?从理论或者对现实世界的了解来看是什么情况。

b)进一步解释评估要点。

•回到问题上。评价点如何改变或支持你对问题的回答?

二、可以选择哪些因素进行Evaluation?

评估时有许多不同的可能因素可供选择。其中一些将针对问题。下面是几个来自微观经济学和宏观经济学的典型例子。

微观经济学:

•需求的价格弹性。

•商业目标。

•公司实际上是如何处理利润的。

•短期和长期。

宏观经济学:

•经济中的闲置产能水平。

•短期和长期。

•当前政策立场(如当前利率水平或当前预算赤字规模)。

•乘数效应的大小。

三、Evaluation应用示例

题目:Assess whether governments should put in place a sugar tax.评估政府是否应该征收糖税。

Point 1 – Diagram for sugar tax

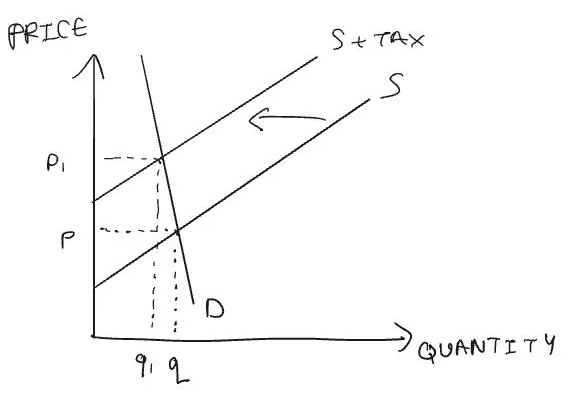

Sugar tax diagram means lower quantity, higher price, reducing the size of any negative externality e.g. in terms of increased use of health service. I might use a diagram like the one below to show the effect of a tax. In the exam this diagram would be fully explained.

Evaluation:

The effect of a tax depends on the price elasticity of demand (PED) for the good being taxed. If the demand is price-inelastic, then the tax will lead only to a small fall in quantity and a larger rise in price. This would mean little effect on consumers’ health. Sugar can be addictive and so is likely to have an inelastic PED, meaning the tax on its own may have less direct benefits for consumer health.

分析:确定的评价因素是需求的价格弹性。确定了非弹性PED的影响。基于成瘾物品更可能具有无弹性PED的理论,然后做出判断。请注意,你可以从另一个方向做出判断,例如,如果你认为随着时间的推移,企业会创造出更多含糖饮料的替代品,这将意味着与短期相比,PED在长期会变得更有弹性。

Point 2 – Firms’ costs

Increased costs for firms leads to lower profits, employment and investment in sugar industries.

Evaluation:

The effect on firms’ costs depends on whether firms change their products. Firms may switch to producing non-sugary drinks which do not face the sugar tax. This means the tax would not increase firms’ costs as much, so there would be less harm to profits and employment in the sugar industry. for example Coca-Cola could produce more sugar-free Coca-Cola, to avoid the sugar tax. Some firms are also increasing the use of sugar substitutes, such as stevia, in some soft drinks. So firms’ costs are likely to increase less as firms have shown they can adapt their products.

分析:这里的评估点是关于企业是否改变他们的产品选择。这一段解释了转向无糖饮料对公司的影响。使用来自真实世界的数据支持公司可能转换的想法,然后做出判断。

Points 3 – Inequality

A per-unit tax on sugar may increase poverty and post-tax inequality. The tax means consumers pay more for sugary drinks and the tax takes up a larger proportion of a poorer consumer’s income, compared to the income of a richer consumer.

Evaluation:

The effect on inequality may depend on what the government does with the revenue raised. For example, some of the revenue could go towards increased welfare payments for those on low incomes. This would mitigate any effect on inequality, while still incentivising sugar consumers to reduce their consumption (particularly those on high income). However at the moment the UK Government has a very large budget deficit of 14.5% of GDP in the year ending March 2021. Hence any tax funds raised are likely to go towards closing the budget deficit rather than increased welfare payments. This means inequality is likely to increase as a result of the tax.

分析:这里的关键因素是政府如何处理税收。这一段解释了这一点的重要性,然后用真实世界的证据来判断预算赤字。

以上就是有关A-level经济学论文Evaluation部分的内容,希望对大家有帮助,想要了解更多关于A-level经济学Essay真题、A-level经济学Essay范文、A-level经济学Essay辅导等问题,可以随时在线咨询哦~

凡来源标注“惟世教育”均为惟世教育原创文章,版权均属惟世教育所有,任何媒体、网站或个人未经本网协议授权不得转载 链接、转贴或以其他任何方式复制、发表。未注明来源等稿件均为转载稿,如涉及版权请联系在线客服处理。

免费获得学习规划方案

已有 2563 位留学生获得学习规划方案

马上领取规划

*已对您的信息加密,保障信息安全。

在线咨询

在线咨询

免费通话

免费通话