Alevel经济学在课程体系和本科申请的赛道中是竞争力非常强的一门科目,不仅仅在经济学专业申请中需要高中经济学课程的学习和成绩,许多的会计、贸易、甚至是历史这样的人文学科也是非常需要经济学知识积累的。

但alevel经济学的知识点繁杂,遇上essay写作的时候更是想不起到底用哪一个知识点来支撑自己的观点,为帮助大家更好地学习备考,我们考而思惟世为大家梳理过许多有关alevel经济学的内容,这次和大家分享的alevel经济学Fixed Rate两面性的相关内容,一起来看看吧!

A Fixed Exchange Rate System 固定汇率制度

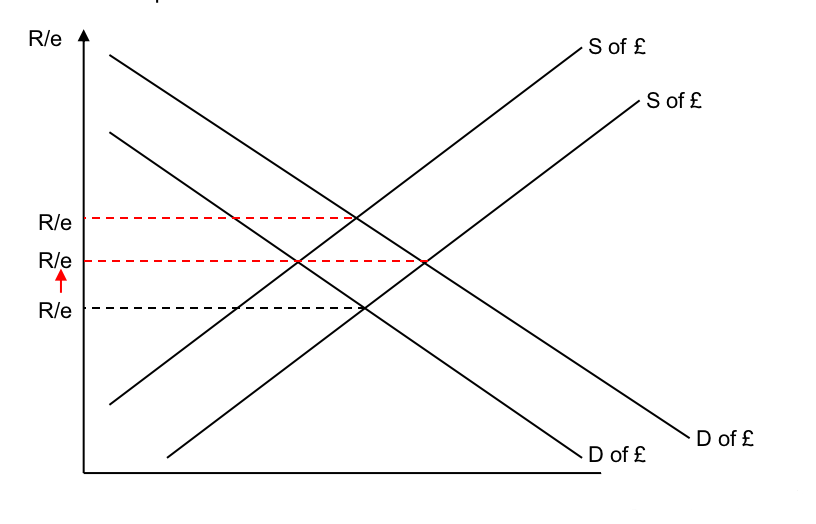

This is one where the parity (exchange rate value, for example £1 = $1.50) of the currency is pegged against other currencies. If the parity comes under threat by market forces, the central bank (controlled by the government) will step in to maintain he value by buying or selling the currency and/or changing its rate of interest.

这是一种货币的平价(汇率值,例如1英镑=1.5美元)与其他货币挂钩的制度。如果平价受到市场力量的威胁,中央银行(由政府控制)将介入,通过购买或出售货币和/或改变其利率来维持其价值。

Advantages of a Fixed Rate System 固定利率体系的优势

1. It gives stability for firms and households - this will increase investment and trade. 它为公司和家庭提供了稳定性--这将增加投资和贸易

2. They act as a constraint on domestic inflation – if a country has higher inflation than its trading partners, it will become uncompetitive. Firms have to control costs in order to compete. 它们对国内通货膨胀起到制约作用--如果一个国家的通货膨胀率高于其贸易伙伴,它将变得没有竞争力。企业必须控制成本,以便竞争

Disadvantages of a Fixed Rate System 固定利率体系的缺点

1. A government must have sufficient reserves to intervene to maintain the price of its currency. 政府必须有足够的储备来进行干预,以维持其货币的价格

2. A country’s firms may be uncompetitive if the exchange rate is fixed at too high rate. 如果汇率被固定在过高的水平上,一个国家的企业可能会失去竞争力

3. The government must make intervention priority. This may mean it undertakes policies which damage the domestic economy for example to keep demand for pounds up in the exchange rate market the government might increase interest rates. The problem is that this leads to less demand within the economy. 政府必须优先进行干预。这可能意味着它采取了损害国内经济的政策,例如,为了保持汇率市场上对英镑的需求,政府可能会提高利率。问题是,这将导致经济中的需求减少

Managed Exchange Rates 有管理的汇率

In reality there is no currency in the world that is allowed to be completely freely floating. Even where governments try to be as non-interventionist as possible, there will come times when the currency is subject to extreme fluctuations and the government, or central bank, will feel that they must intervene. In the same frequent changes in an exchange rate, if completely free floating, may cause uncertainty for businesses, which is not good for trade, and so governments will be forced to intervene in order to stabilize the exchange rate. Because of the above factors, most exchange rate regimes in the world are managed exchange rates. These are exchange rates where the currency is allowed to float, but with some element of interference from the government.

在现实中,世界上没有一种货币被允许完全自由浮动。即使在政府尽量不干预的情况下,也会有货币出现极端波动的时候,政府或中央银行会觉得他们必须进行干预。在同样的情况下,汇率的频繁变化,如果完全自由浮动,可能会给企业带来不确定性,这对贸易不利,所以政府将被迫进行干预,以稳定汇率。由于上述因素,世界上大多数汇率制度是有管理的汇率。这些汇率是允许货币浮动的,但有来自政府的一些干预因素。

The government may choose to intervene in the foreign exchange market to influence the value of their currency. They would do this for several reasons 政府可能会选择干预外汇市场以影响其货币的价值。他们这样做有几个原因 :

Lower the exchange rate in order to increase employment 降低汇率,以增加就业

Raise the exchange rate in order to fight inflation 提高汇率以对抗通货膨胀

Maintain a fixed exchange rate 维持固定汇率

Avoid large fluctuations in a floating exchange rate 避免浮动汇率的大幅波动

Achieve relative exchange rate stability in order to improve business confidence 实现相对汇率稳定,以提高商业信心

Improve a current account deficit 改善经常账户赤字

The supply of £’s is provided by those in the UK wishing to import as they need foreign currency to pay for goods. Therefore they must exchange the pounds for the foreign currency.

英镑的供应是由那些希望进口的英国人提供的,因为他们需要外国货币来支付货物。因此,他们必须将英镑兑换成外币。

(↓ r/e) → (x = Cheaper) → (m = expensive) → (X ↑/M↓ = current account surplus) → (AD = C+I+G+(X-M)) → AD shifts right

以上就是小编为大家整理的Alevel经济学Fixed Rate两面性知识点总结,希望对大家有所帮助,考而思惟世为需要参加国际课程学习、语言测试和留学面试等等方面的同学们提供对应的辅导,祝各位学业有成金榜题名!如有更多有关Alevel辅导的需要,欢迎来联系在线客服老师,会获得更多专业的指导哦!

凡来源标注“惟世教育”均为惟世教育原创文章,版权均属惟世教育所有,任何媒体、网站或个人未经本网协议授权不得转载 链接、转贴或以其他任何方式复制、发表。未注明来源等稿件均为转载稿,如涉及版权请联系在线客服处理。

免费获得学习规划方案

已有 2563 位留学生获得学习规划方案

马上领取规划

*已对您的信息加密,保障信息安全。

在线咨询

在线咨询

免费通话

免费通话